Explore Refinance Loans

Refinance Options.

Choose from short or long terms, fixed or adjustable rates, cash-out1 or jumbo loans, and more. No matter what you’re looking for, we have a refinancing option that will work for you.

Fixed-Rate Mortgage

Predictable monthly payments

A fixed-rate mortgage refinance offers homeowners predicatblity, with a consistent interest rate and monthly payment. Options are available in both 15 & 30 year terms.

APPLY NOW

Jumbo Loan

For high-cost areas

If a home’s value has increased and now exceeds standard conforming loan limits, or is in an area with high home cost, a jumbo refinance can be viable solution.

APPLY NOW

USDA Loan

Rural Refinance

While USDA refinances are only available in rural areas outlined by the USDA, you may be surprised to learn that many suburban areas are able to qualify.

APPLY NOW

Adjustable-Rate Mortgage

More payment flexibility

Refinancing to an adjustable rate mortgage may help you get a lower rate during the introductory period, but after that your rate (and your payments) could fluctuate with the market.

APPLY NOW

FHA Loan

Relaxed qualification requirements

FHA refinance loans can help lower your payment with flexible income and credit requirements. Backed by the government, helps to make refinancing more affordable.

APPLY NOW

Cash-Out Refinance

Turn your equity into cash

If your home is worth more than you owe on your mortgage, you’ve built up equity. A cash-out allows you to turn that equity into cash to use however you want.

APPLY NOW

Conventional Loans

Offers lower rates

A conventional loan refinance may sui homeowners who have improved their credit scores or income since securing their initial mortgage.

APPLY NOW

VA Loan

Benefits for Veterans

A VA refinance helps qualified military members, veterans and their families secure a mortgage that fits their needs. No down payment and no PMI required.

APPLY NOW

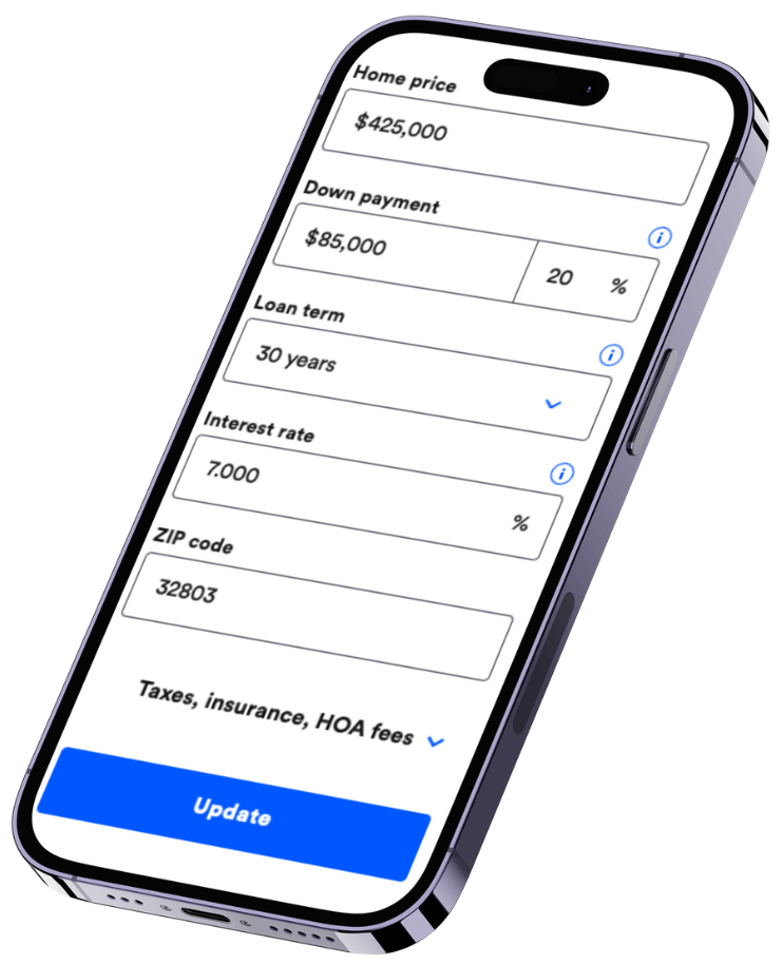

Explore your options with our easy-to-use Mortgage Calculator.

How much house can I afford? Use our Mortgage Calculator to learn about Closing Costs, Property Taxes and Homeowner Insurance. Let us help get you started.

(321) 624-3746

615 Crescent Executive Ct. Suite 224 Lake Mary, FL 32746

NMLS #210950

TERMS OF USE | PRIVACY POLICY